York City Centre Insights Q3-2024

York BID work regularly with data suppliers to bring together insights on the economic performance for York city centre. Our quarterly report is divided into sections focusing on key metrics such as debit card spend, footfall, and visitor behaviours, as indicators of commercial success, across a 3-month period (July-September 2024). Click on the charts to view them expanded to large scale.

Businesses are invited to review and compare the trend figures with their own data sources to aid with their day-to-day trading. All merchant and customer data shown is strictly anonymised and aggregated to comply with GDPR and data protection requirements.

SPEND

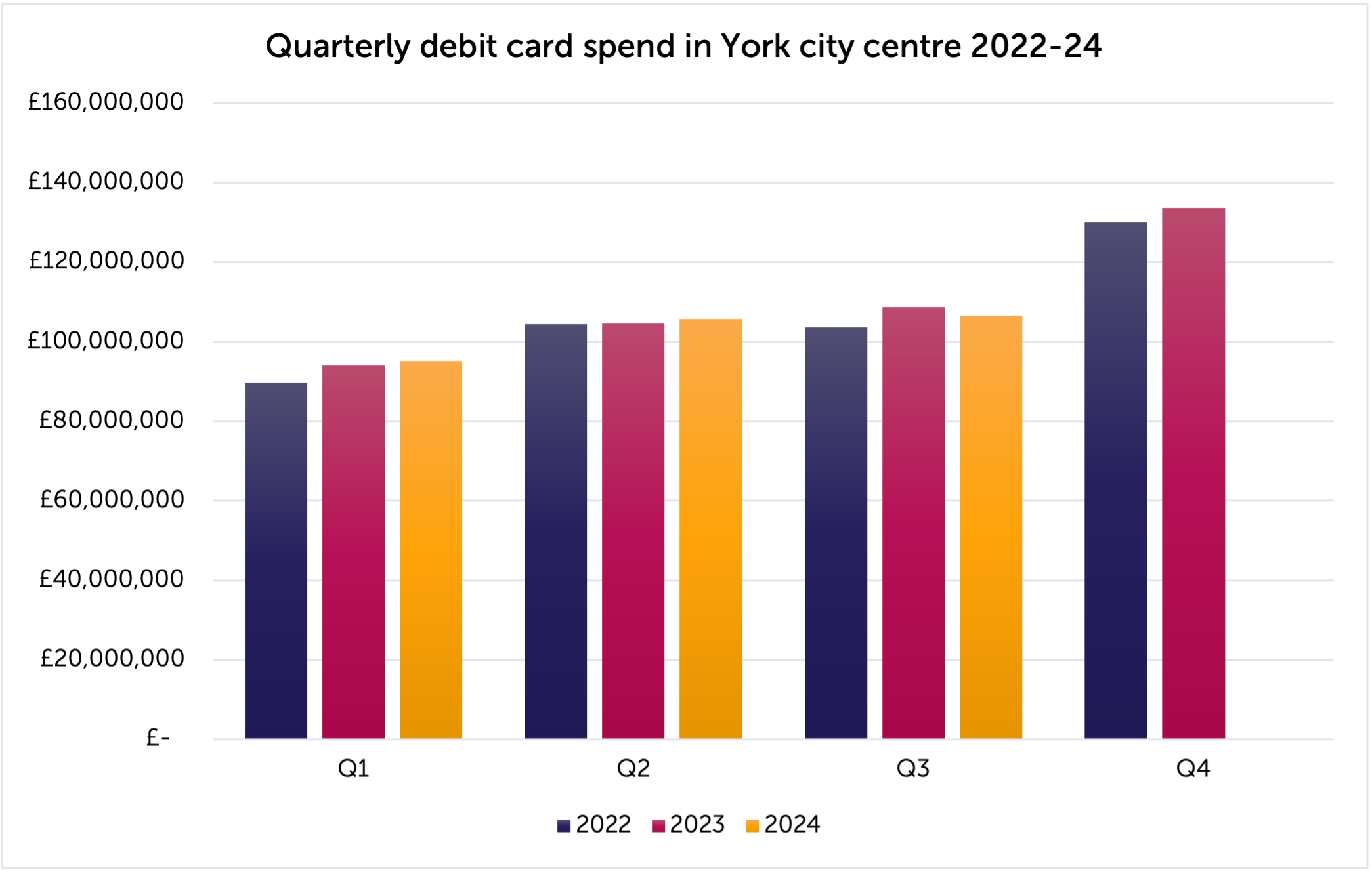

During Q3, in-store spending via debit card transaction was down by -1.9%, compared to the same period in the previous year (See figure 1). Comparatively, in-store debit card spending across the rest of the UK was down by -6.3%.

39.2% of the total quarterly spend was made by residents of the York Unitary Authority area, whereas 60.8% was made by visitors from further afield.

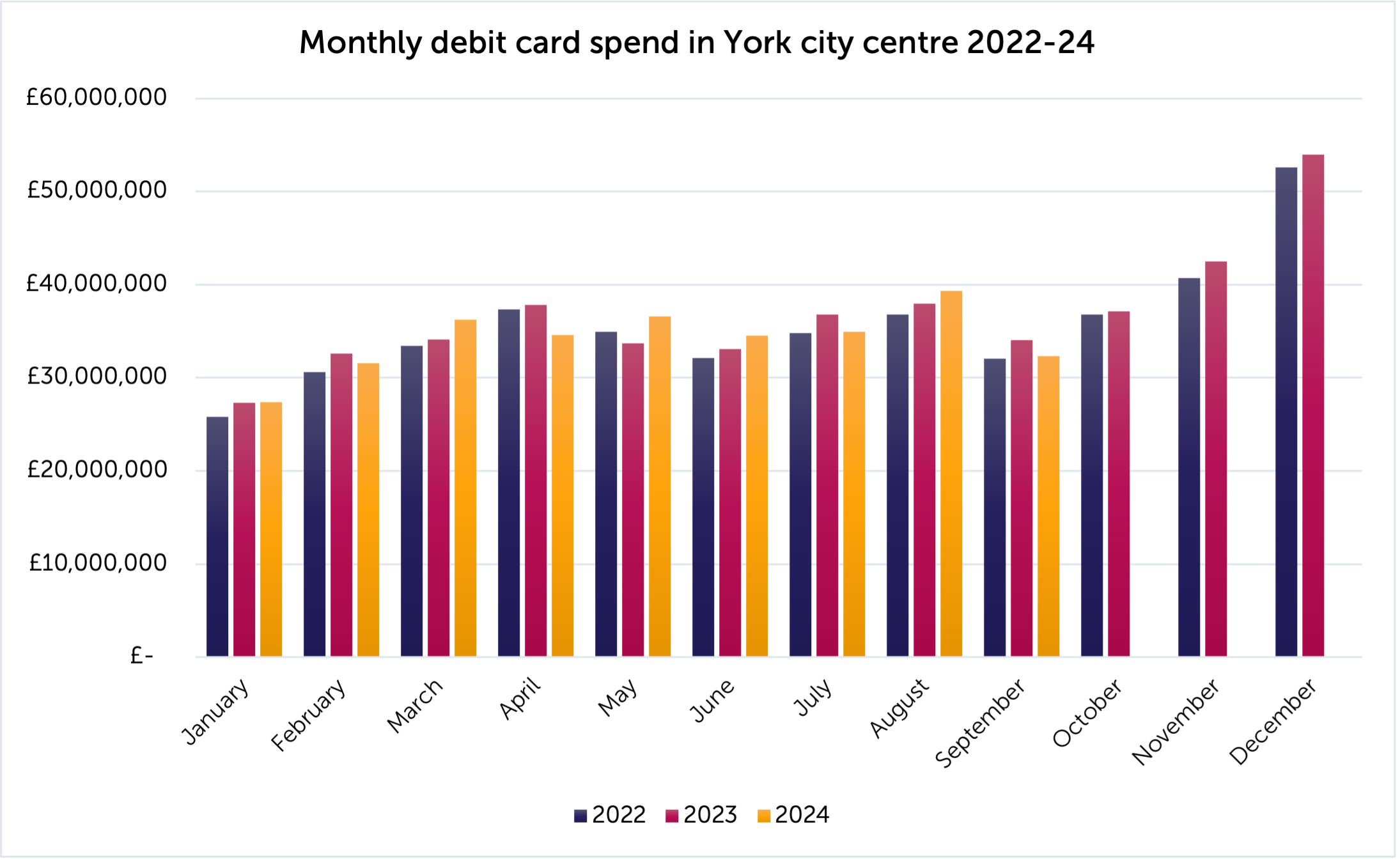

By the end of September 2024, year-to-date spend was the same as levels recorded in 2023. The highest monthly spend levels were recorded during August, which was up by 3.7% compared to the previous year (See figure 2).

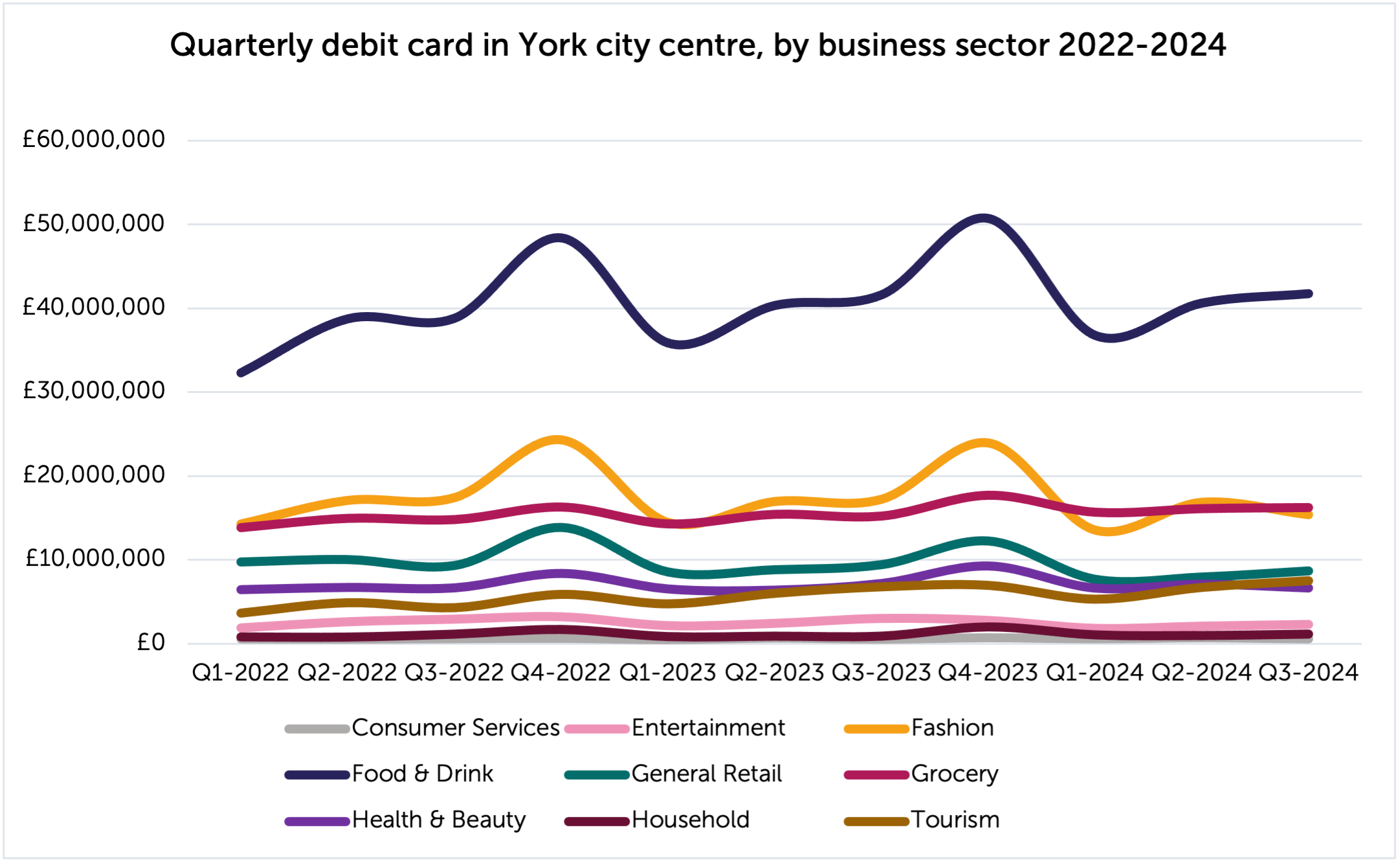

The Food & Drink sector received the largest spending levels, accounting for 39.1% of the quarterly total, which is slight increase of 0.3% compared to the previous year (See figure 3). Spending in the Tourism sector (hotels, serviced accommodation, travel agents etc.) increased by 10.6% year-on-year, whereas spending in General Retail and Fashion decreased by -9.3%.

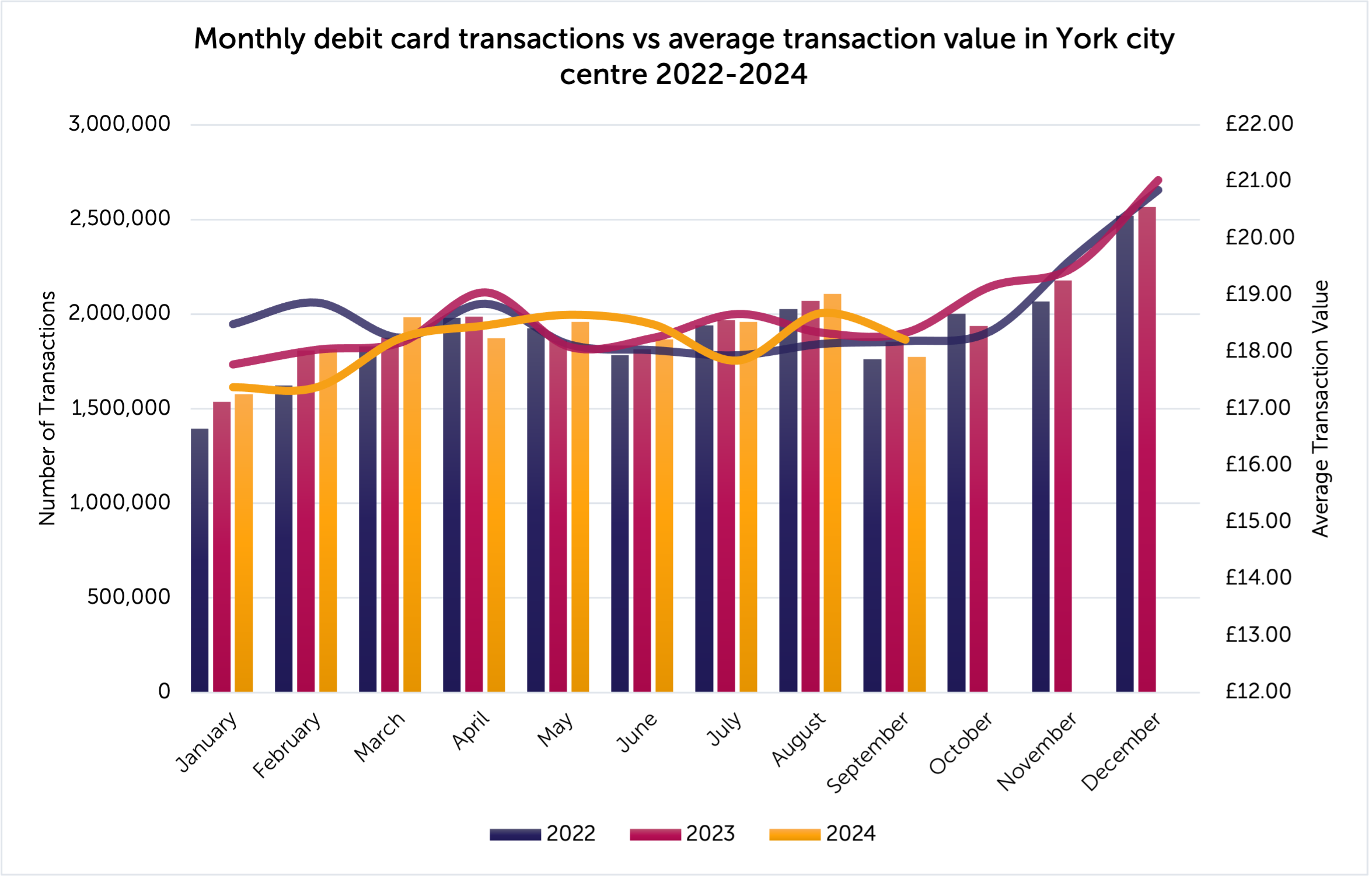

Year-on-year, the total number of card transactions was down by –0.9%, the number of customers was down by -2.8%, and the average transaction value was also down by 1.1% (See figure 4).

Source: Beauclair offers access to a national data-set of in-store debit card transactions from over 11 million individual accounts which can be utilised to calculate spending at city wide and national levels.

Each transaction is geo-tagged to track merchant location, retail sector and online vs offline. New data reports are published monthly.

Click to see the York Area Spend Report – September 2024

Click to see the UK Benchmark Report – September 2024

FOOTFALL

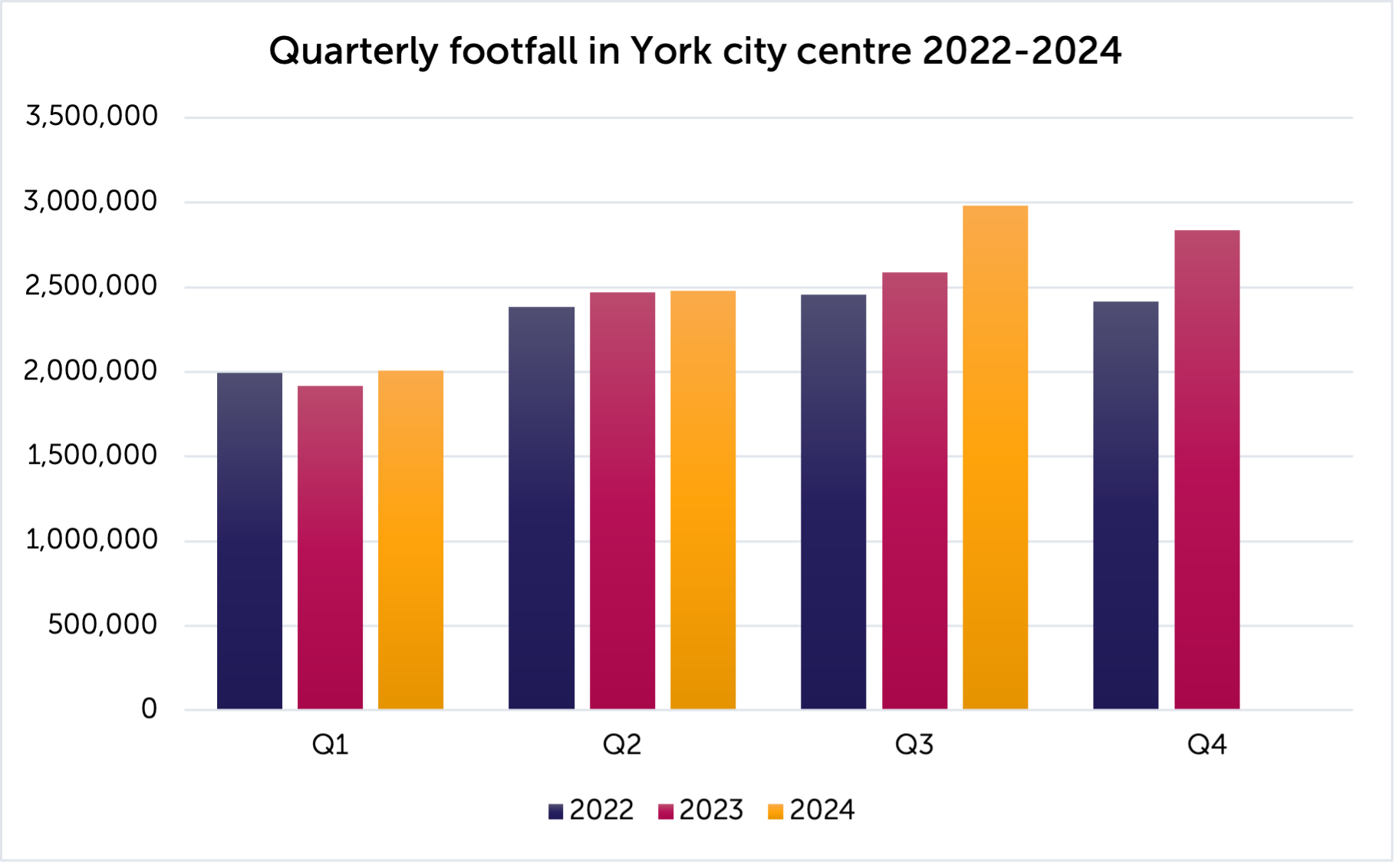

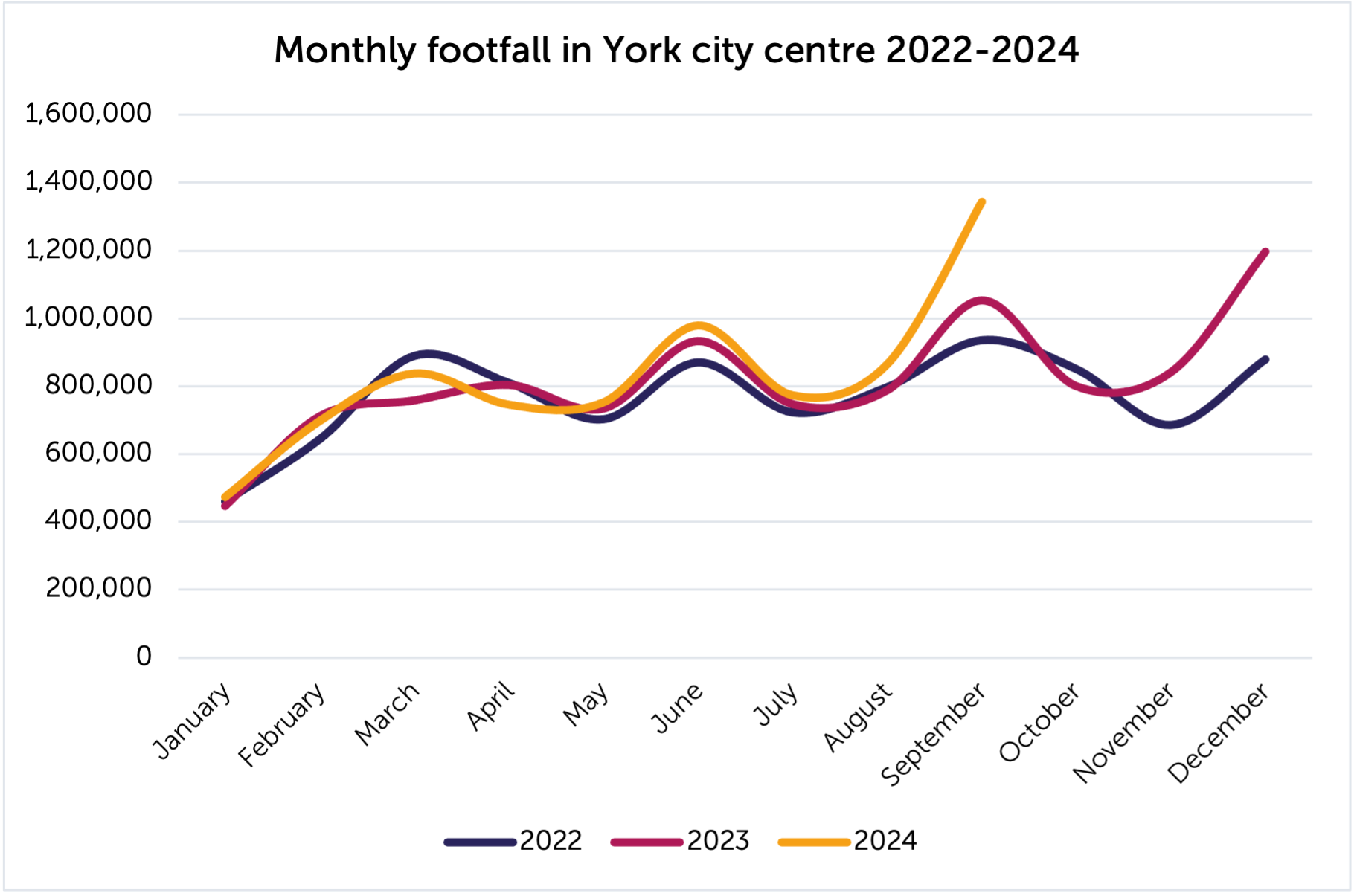

During Q3, the total number of visitors recorded in York city centre was up by 15.2%, compared to the same period in the previous year (See figure 5).

By the end of September 2024, year-to-date footfall was up by 7.0%, compared to the same point in 2023. The highest number of monthly visitors was recorded during September, which was up by 27.7% compared to the previous year (See figure 6).

Comparatively, Year-to-date footfall in North Yorkshire and the rest of the UK was down by -1.7% and -1.1% respectively.

Source: Springboard (Powered by MRI) utilises on-location cameras to measure passing footfall in town and city high streets. There are currently two footfall cameras located in York city centre, on Parliament Street and Micklegate.

Although the dataset is limited, the figures indicate how footfall trends change overtime. New data reports are published on both a weekly and 4-weekly basis.

Click to see the Springboard Footfall Report – September 2024

VISITOR BEHAVIOUR

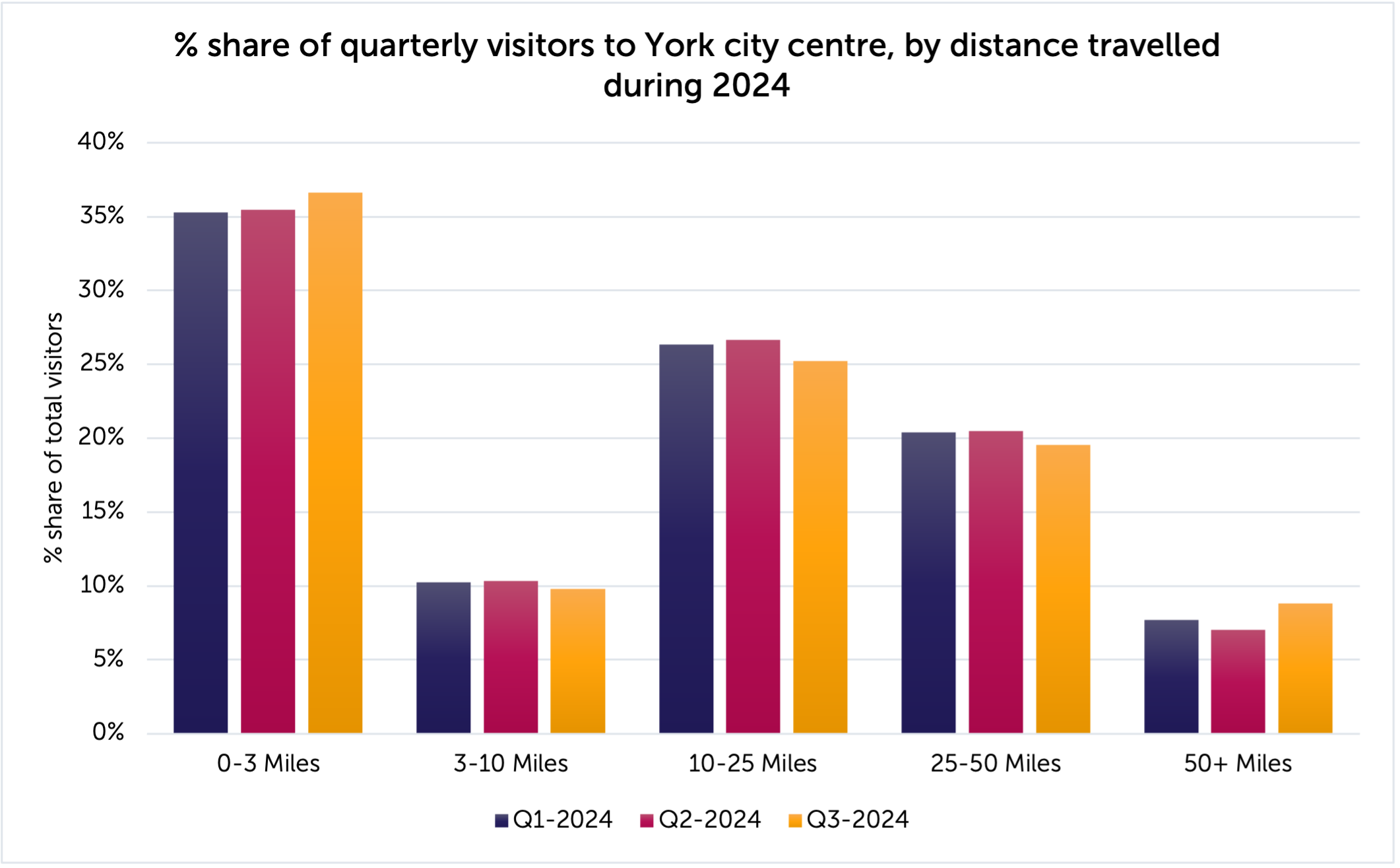

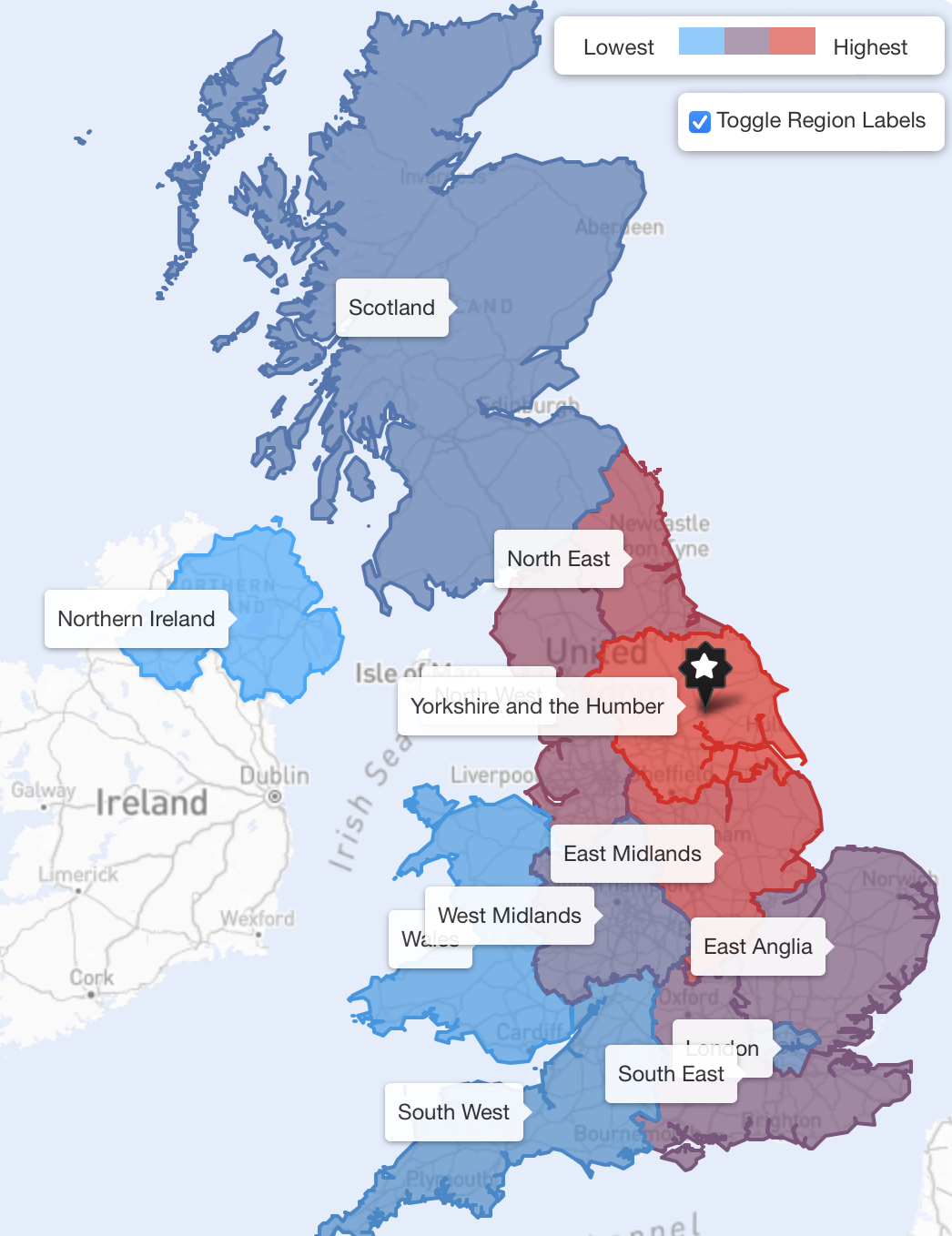

During Q3, 46.4% of the total visits were made by people residing within 10 miles of York city centre, whereas 53.6% travelled from a UK home location of over 25 miles away (See figure 7).

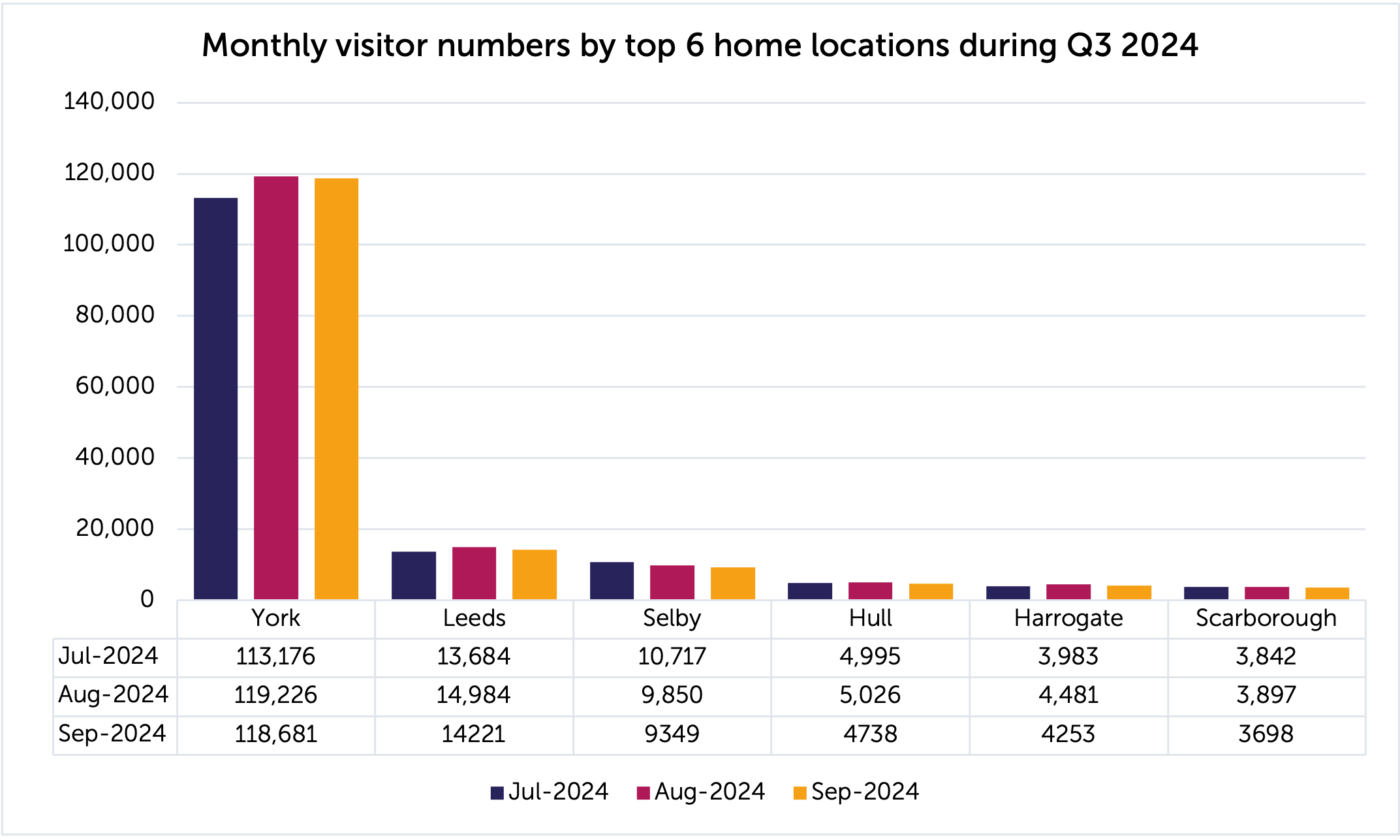

48% of the total quarterly visits were made by residents of the York Unitary Authority area. Leeds and Selby were consistently the second and third highest visitor locations of origin throughout the quarter (See figure 8).

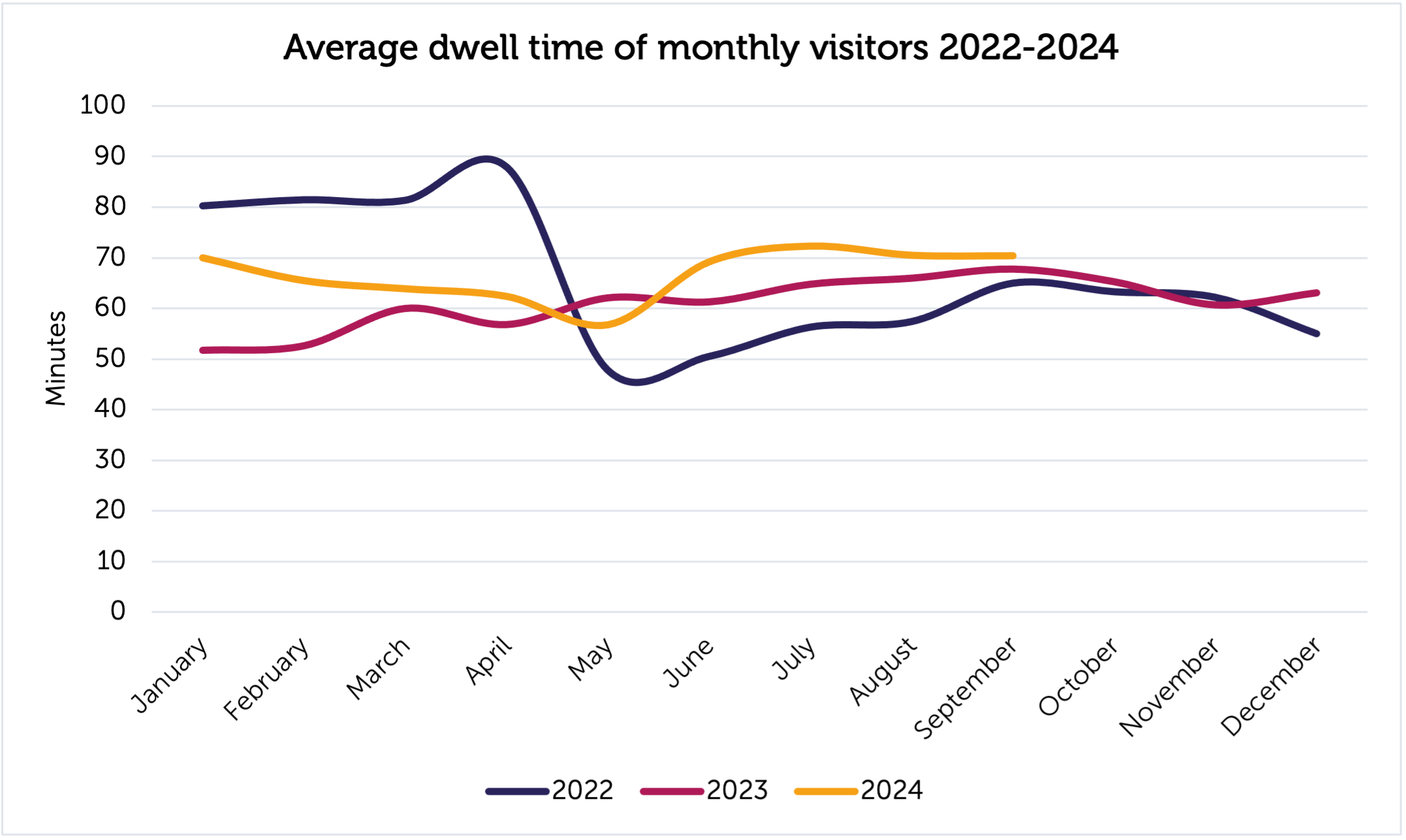

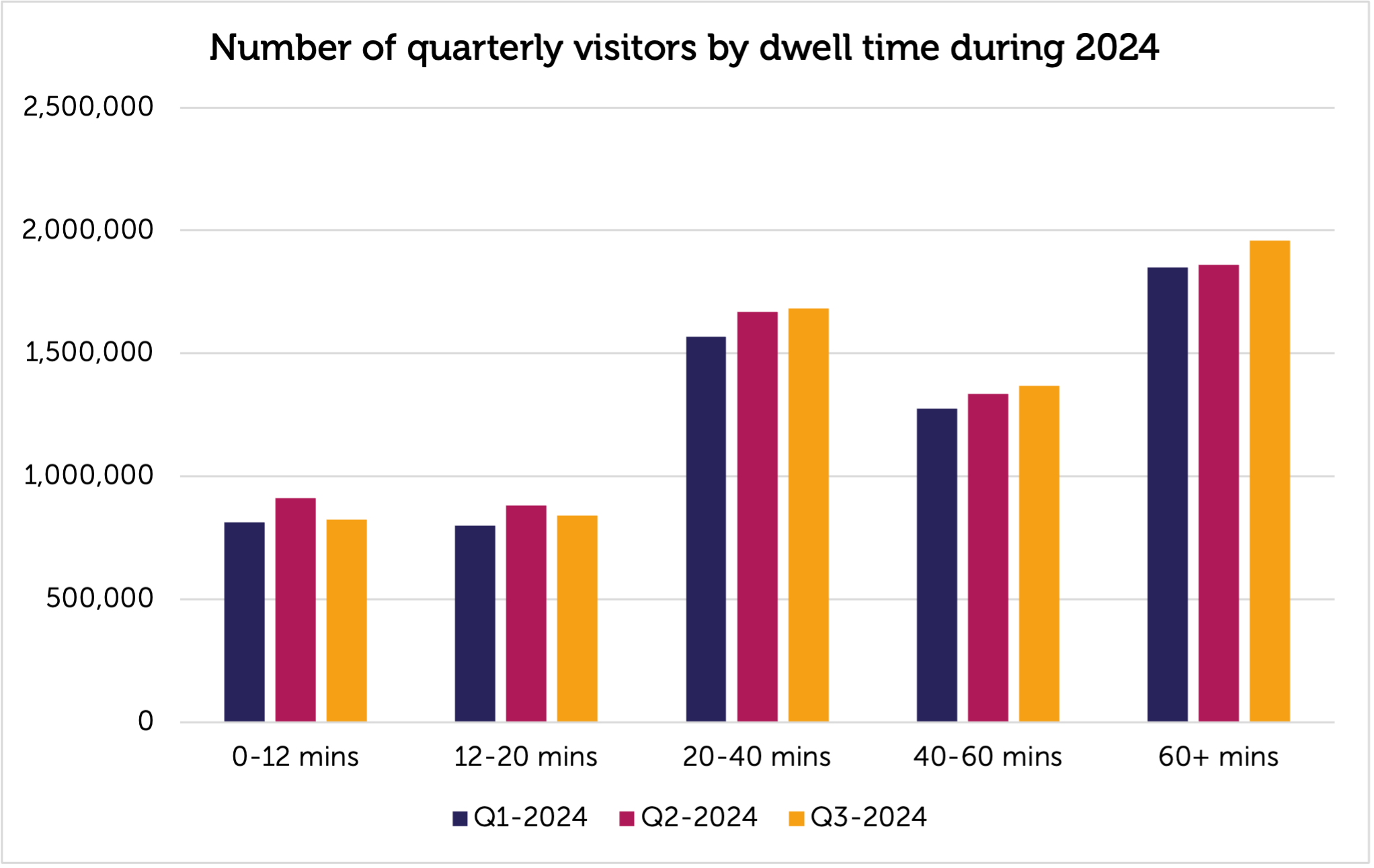

The average dwell time spent by visitors in York city centre, during Q3, was 71 minutes, which is around 5 minutes longer compared to the same period in the previous year (See figure 9). 29% of all quarterly visitors dwelled for over 60 minutes (See figure 10).

PlaceInformatics tracks the movements of over 1 million mobile devices using GPS in the UK to offer insights into visitor behaviour, demographics and home locations. New data reports are published monthly.

HOTEL OCCUPANCY

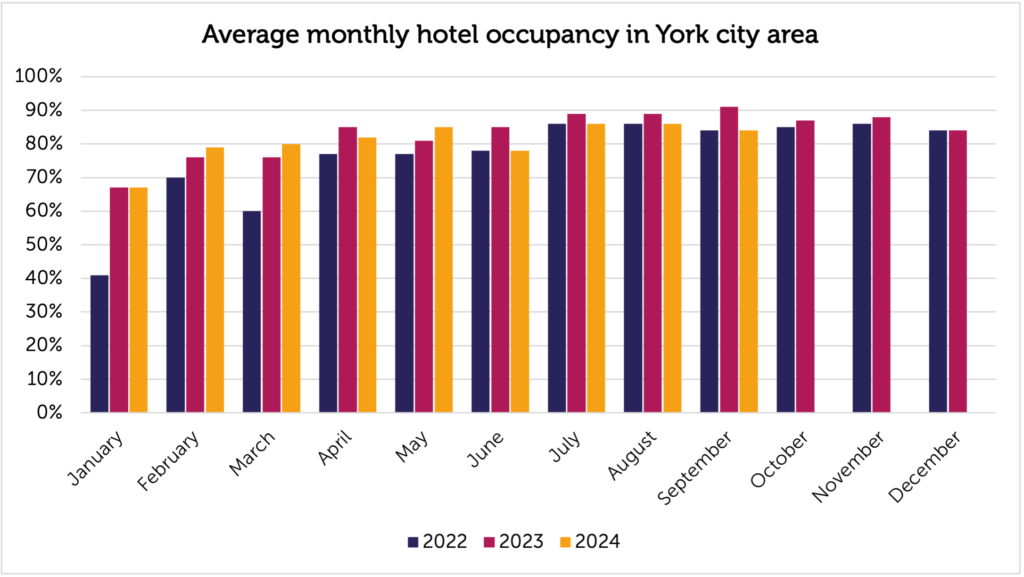

Average hotel occupancy during quarter 3 was down by 5% compared to the same period in the previous year. The highest monthly occupancy levels were recorded during both July and August at 86% (See figure 12).

STR are a data supplier servicing the hotel industry, offering insights into occupancy, profitability and benchmarking against global markets.

SHOP VACANCY

Shop vacancy levels in York city centre at the end of Q2-2024 stood at 8.4%, which is a 0.7% increase on the same period in the previous year (See figure 13).

To see our previous reports, please visit our Insights & Trends page. If you have any questions regarding the data, you are welcome to contact the BID Team on info@theyorkbid.com.